By Mike Gibbons, RICP®

With a world of information at our fingertips, we can find reviews, history, product specifications, and more details than we’ll ever need about anything we want to buy. In other words, before making a major purchase, we can arm ourselves with information to make the best choice possible.

While creating a retirement income plan is in a different category than buying a car or putting an offer on a home, we believe it’s just as significant of an investment and you should know what you’re getting before you pay a penny.

Because we develop custom plans for each client, it’s no easy task to provide one without working with you extensively. However, we wanted to create something that could help you better understand what your potential financial plan could look like so you can see the benefits a plan could bring to your financial life. If you choose to work with us, here is a sample of what you can expect.

What Does a Retirement Income Plan Include?

Transitioning your assets to income after decades of working hard to build your nest egg is an intimidating thing to do. It’s much more emotionally daunting than the accumulation phase, which can often be a roller coaster of its own as markets go up and down and competing financial priorities come your way. Now it’s time to shift both how you think and how you act as you turn what you’ve accumulated into an income for life.

We walk you through a comprehensive process that leaves no stone unturned. We believe a solid retirement income plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, and income strategies to help bring you clarity and guidance. It is through our planning process that we can help you prepare for life’s expected and unexpected circumstances.

The result is a simple yet powerful road map to guide you toward financial freedom.

See a Sample Retirement Income Plan

Here is a sample retirement income plan that reflects our planning process. It looks at a fictional client’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with me. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

We start by providing an overview of your current situation. With just one glance, you can see a big picture of your financial life, including assets broken down into specific categories and short-term and long-term liabilities.

We also include a detailed breakdown of all your financial resources so that our plan can factor in everything from interest to timing to taxes.

Our financial planning is goals-based. This means we help you develop specific budgets for your future goals and needs—pre and post retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning software allows us to bring all these things together in a comprehensive way that makes sense.

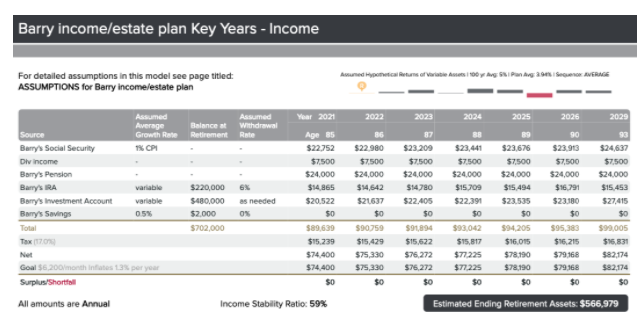

Finally, we build out a detailed cash flow plan, incorporating the assumptions we’ve built and the financial needs and goals we’ve outlined.

The end result? An actionable implementation list and a road map for your future.

Get Started on Your Plan!

If you want to see even more aspects of our retirement income plans, download our [full sample plan here]. Once you’ve taken a look, contact us at Gibbons Financial Group today to schedule a complimentary consultation by calling 224-419-5550 or emailing me at Mike@gibbonsfinancialgroup.com. And be sure to join our free webinar, Retiring Early From Pharma.

About Mike

Michael J. Gibbons is founder and president of Gibbons Financial Group, an independent advisory firm providing custom-tailored financial planning and investment management services to pharmaceutical and healthcare professionals and their families. Mike has over 25 years of experience and spends a significant portion of his day working with pre-retirees and retirees, focusing on asset management, Social Security and pension planning, as well as retirement income preparation.

Mike has degrees in both business and psychology from Lake Forest College and currently holds his Retirement Income Certified Professional (RICP®) designation from the American College. Mike was named a Five Star Wealth Manager for 2016 and 2018* Mike is heavily involved in his community, having served on the Village of Gurnee Police Pension Board as a Community Volunteer and the St. Patrick’s Parish Financial Board. When he’s not working or volunteering, Mike loves playing golf and spending his time with his wife and children. To learn more about Mike and how he can help you, connect with him on LinkedIn, visit his website, and register for his free webinar, Retiring Early From Pharma, created specifically for professionals retiring from the pharmaceutical, biotechnology, and healthcare industries.

*Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience, and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of 2016/2018 Five Star Wealth Managers.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.